HONG KONG / NEW YORK / VANCOUVER – January 5, 2026 – Following a year of historic growth and regional expansion, ELIM Investment Management (“ELIM”) is proud to announce the successful conclusion of its 2025 fiscal year. Together with our valued property managers, sponsors in North America, and our esteemed equity partners, ELIM has fortified […]

Explore Our Assets

Explore Our Assets

Explore Our Assets

Explore Our Assets

builder partner network

Explore Our Assets

Explore Our Assets

Explore Our Assets

Explore Our Assets

ELIM 2.0

A Leader in Real Estate.

ELIM Investment Management is a privately held real estate investment firm with over 10 years of experience to underwrite, acquire, structure, manage and service real estate equity and debt investments in United States and Canada.

OUR CULTURE

Real Estate is a long term ownership. We focus on professional development and relationship with all stakeholders in our business

OUR CULTURE

Real Estate is a long term ownership. We focus on professional development and relationship with all stakeholders in our business.

OUR TEAM

Our team has managed its investments in private real estate equity and debt through distinct market cycles. We focus on interest alignment and provide custom investment portfolios for institutional investors, private clients and family offices to help them achieve their investment objectives.

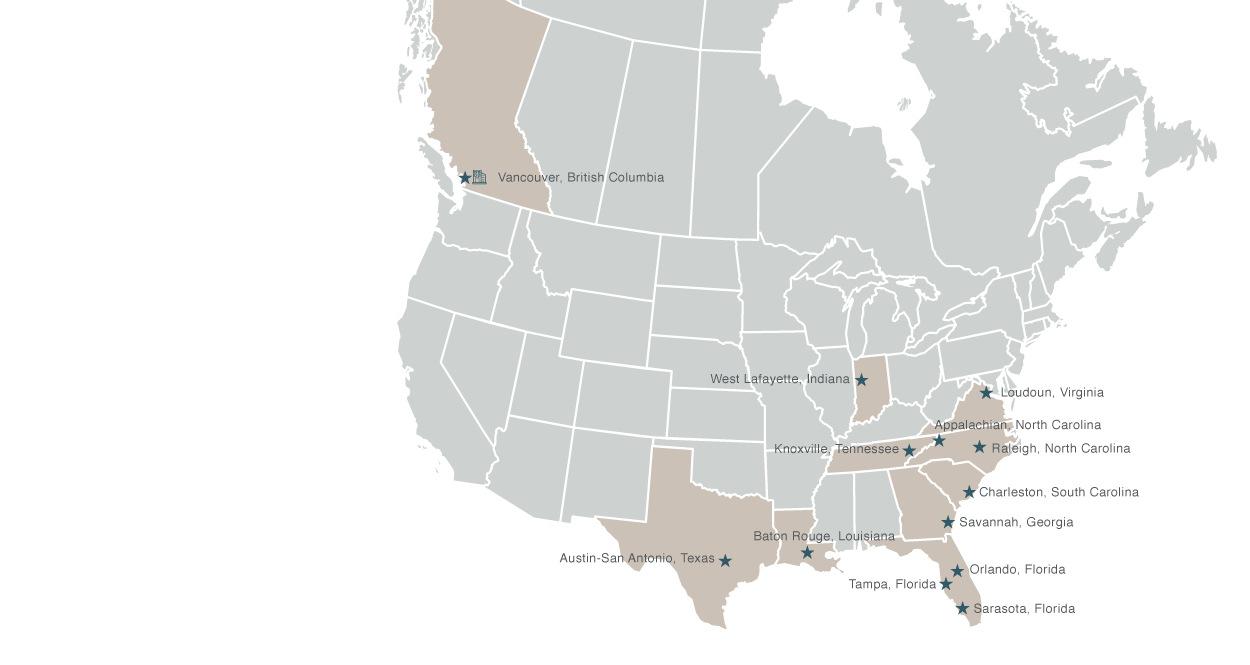

Our FootPrint

ELIM identifies and capitalizes on investment opportunities in regions demonstrating robust rental growth and property appreciation potential. We prioritize regions with strong fundamental economic indicators, including consistent job growth, population growth, and strong business activities. Our focus is exclusively on the acquisition and development of rental housing assets within the United States and Vancouver, Canada.

Our FootPrint

ELIM identifies and capitalizes on investment opportunities in regions demonstrating robust rental growth and property appreciation potential. We prioritize regions with strong fundamental economic indicators, including consistent job growth, population growth, and strong business activities. Our focus is exclusively on the acquisition and development of rental housing assets within the United States and Vancouver, Canada.

Diversifying Your Portfolio with Income and Growth Strategies in Real Estate

Core-Plus Strategy

Class A Properties with above 95% existing occupancy, expected annual returns range from 10-13%. Moderate Leverage with debt levels around 60%. High-quality tenants in good locations.

Value-Add Strategy

Class B to A Properties with above 85% existing occupancy, expected annual returns range from 13-16%. Higher Leverage with debt levels around 65%. Enhancing value through improvements, lease optimizations and increasing occupancy rates.

Opportunistic Strategy

Class A New Development Properties in desired locations, outsized returns. Higher leverage and/or preferred equity. Established builders and property managers with solid track record.

Download Brochure

Please download our Company introduction to learn more our investment approach, track record, and how we work.

Our FootPrint

ELIM identifies and capitalizes on investment opportunities in regions demonstrating robust rental growth and property appreciation potential. We prioritize regions with strong fundamental economic indicators, including consistent job growth, population growth, and strong business activities. Our focus is exclusively on the acquisition and development of rental housing assets within the United States and Vancouver, Canada.

News and Insights

September 8, 2025 – Elim Investment Management has acquired four premier multifamily properties totaling 742 units in Dallas’ vibrant Knox Henderson district. In partnership with leading institutional investors, these acquisitions mark a significant expansion of Elim’s U.S. portfolio. Purchased at approximately 30% below replacement cost, these well-maintained mid-2000s properties are poised for transformation. The operator […]

The U.S. dominates as the top destination for Japanese real estate investment, with Texas as the leading hub, far outpacing markets like Europe. Japanese conglomerates, including Sumitomo Forestry, Sekisui House, Marubeni Corporation, Yamasa Corporation, Daiwa House Group, and Misawa Homes, are transforming Texas’ housing market, investing billions in multifamily and single-family developments from 2020 to […]

Why are global institutional investors eyeing Dallas-Fort Worth’s multifamily market? What makes 2025 a strategic moment to seize undervalued assets in this booming metro? DFW’s dynamic economy, soaring apartment demand, and a rebalancing supply-demand phase are driving value-add and core-plus opportunities, offering foreseeable rent growth and asset appreciation over a 3-5 year horizon. With a […]

Unlocking Value in Distressed CRE: A Guide to Smart Multifamily Investments – Part 2

Part 2: Mitigating Legal, Regulatory, and Strategic Risks Distressed commercial real estate (CRE), especially multifamily properties, presents unique risks that can derail even the most promising deals. Understanding and mitigating legal, regulatory, and strategic risks is essential to ensure a distressed investment delivers value. Below, we outline key risk areas to focus on when evaluating […]