U.S. Housing Market Challenges Drive Multifamily Rental Demand

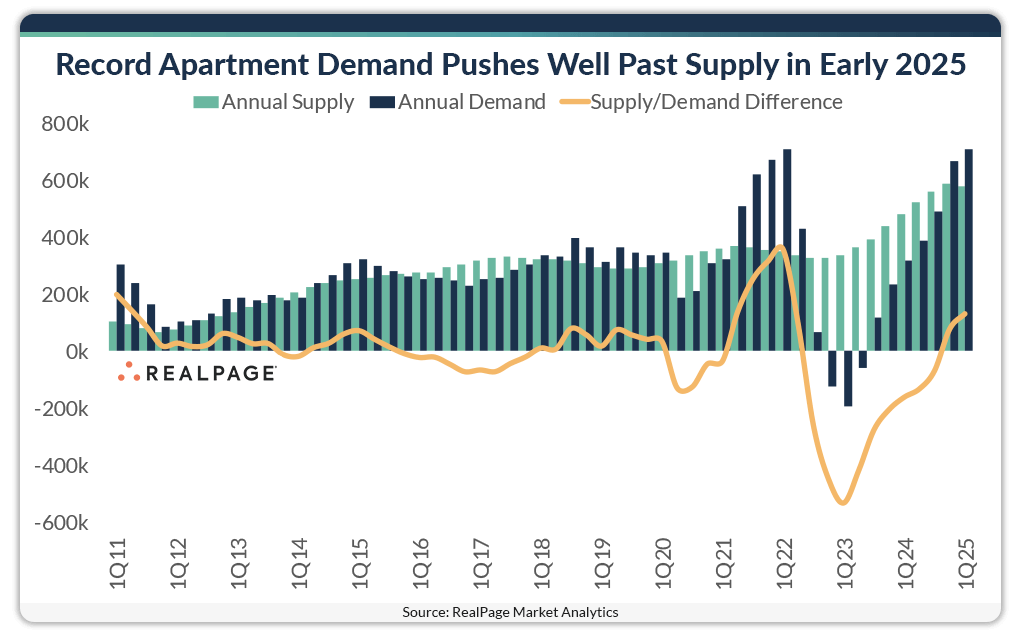

The U.S. housing market is grappling with significant obstacles, including high home prices, rising insurance and property tax, limited inventory, and 30-year fixed mortgage rates reaching 6.9% as of April 20. These factors are preventing many potential buyers from purchasing, leading them to remain renters for longer. The affordability gap has widened consistently over the past few years, and many national homebuilders including D.R. Horton, Lennar and KB Home have indicated recently that the typical spring selling season is now off to a slow start. While home sales are slow, we see a strong demand for multifamily rental properties, with Q1 2025 achieving a record-breaking absorption of over 138,000 units—the strongest first quarter ever recorded. According to RealPage, projections estimate nearly 460,000 units will be absorbed in 2025, down about 26% from 2024’s total, yet still reflecting robust renter demand amid economic uncertainties.

Tariffs and High Interest Rates Tighten Supply

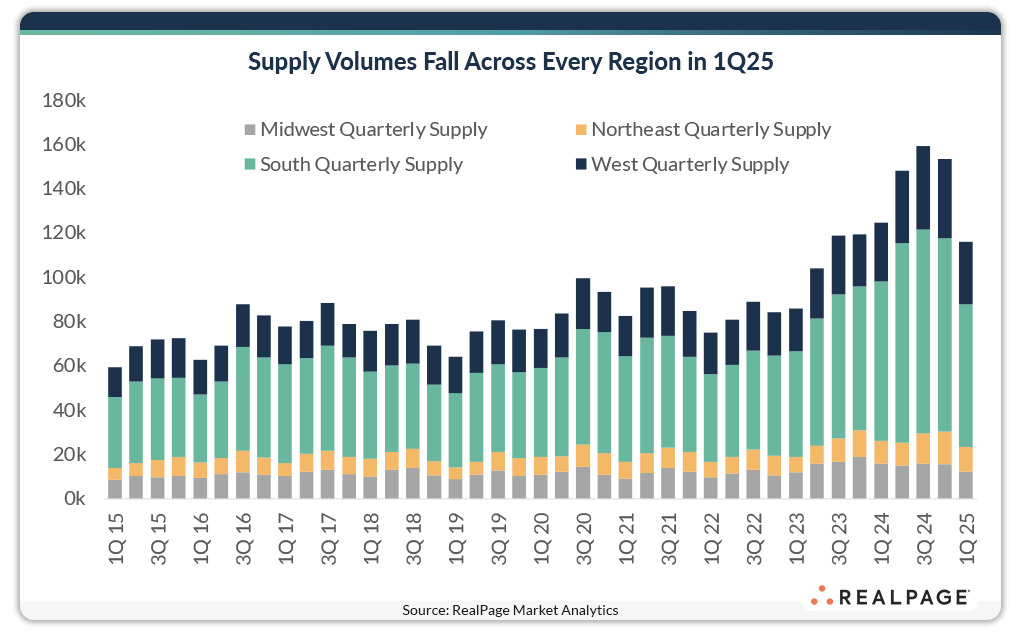

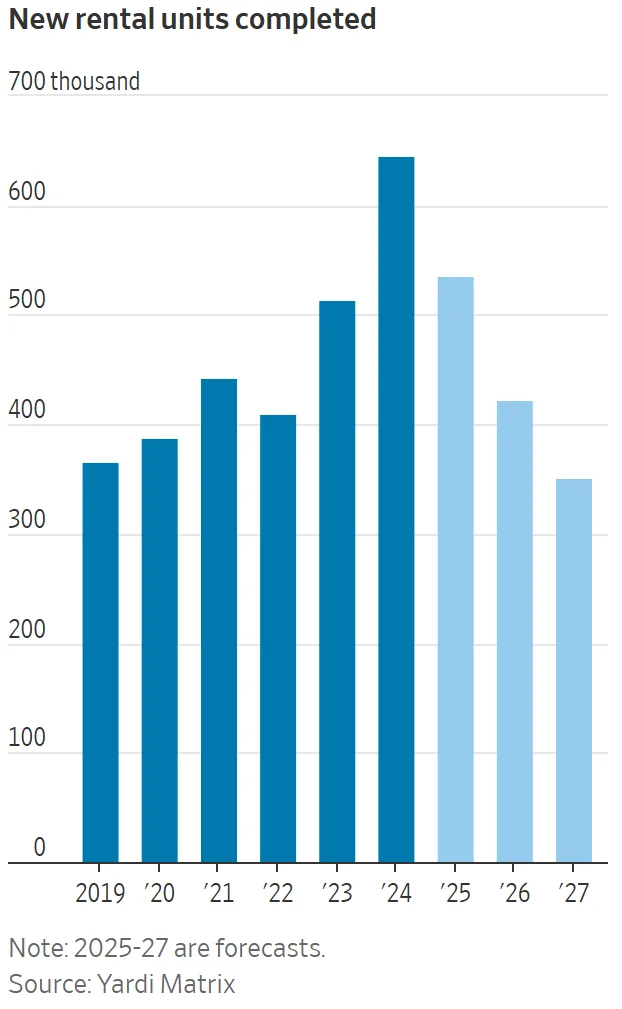

New tariffs are driving up construction and financing costs, contributing to delays in some construction starts. However, the broader decline in starts, permits, and completions is primarily due to high interest rates over the past few years, which have curtailed new multifamily projects. Data shows multifamily completions peaked in 2024 but are projected to decline significantly through 2027, with 2027 deliveries expected to be approximately half of 2024’s levels. With 2025 deliveries forecast to drop 26% from 2024’s 577,000 units, this tightening supply pipeline is supporting rent growth—up 0.3% in Q1, the first such increase since 2022—with potential annual increases of up to 5% annually in the next few years. Developers who completed projects before tariff-induced cost spikes are well-positioned, securing premium rents in high-demand markets.

Resilience Amid Economic Pressures

Despite economic headwinds—slower job growth (456,000 jobs added in Q1, the weakest since 2011 excluding 2020) and rising inflation (core PCE Price Index up 40 basis points in February)—multifamily fundamentals remain robust. Absorption is matching or exceeding new supply, and markets like Richmond are experiencing strong rent gains. Even in oversupplied Sun Belt cities such as Austin and Phoenix, signs of stabilization are emerging. High home price and uncertainty in job security push people to choose rental and high mortgage rates continue to keep renters in apartments, while investor confidence is growing, particularly for core multifamily assets.

Multifamily Sentiment Picks Up Despite Uncertainty

Despite uncertainty from the Trump administration and the Fed’s cautious rate path, the current market presents a strategic opportunity, stronger investor confidence in Q1 as cap rates compressed and underwriting metrics improved. The spread between going-in and exit cap rates for core assets widened. Acquisition deals priced below replacement costs and with high, stable occupancy rates are increasingly attractive, offering investors access to high-value properties that could generate an annual cash yield of 5%-7%. While no investment is without risk, real estate has proven to be one of the most durable and stable options over time, in particular the demographics and economic factors are more favourable to rental properties. During this period, the multifamily rental segment stands out as a sector worth exploring for those seeking resilience and consistent returns.

Act Now to Capitalize

The U.S. multifamily market is at a critical juncture. With completions trending downward, demand surging, and fundamentals stabilizing, now is an opportune time for investors and investment manager to engage. Contact our team today to explore tailored investment opportunities and position yourself in this dynamic market!