Mapping the Future of US Real Estate Investment (2026–2036)

The traditional real estate investment thesis—prioritizing high-population-growth metros and employment statistics—is no longer sufficient to identify the high-alpha opportunities of the next decade.

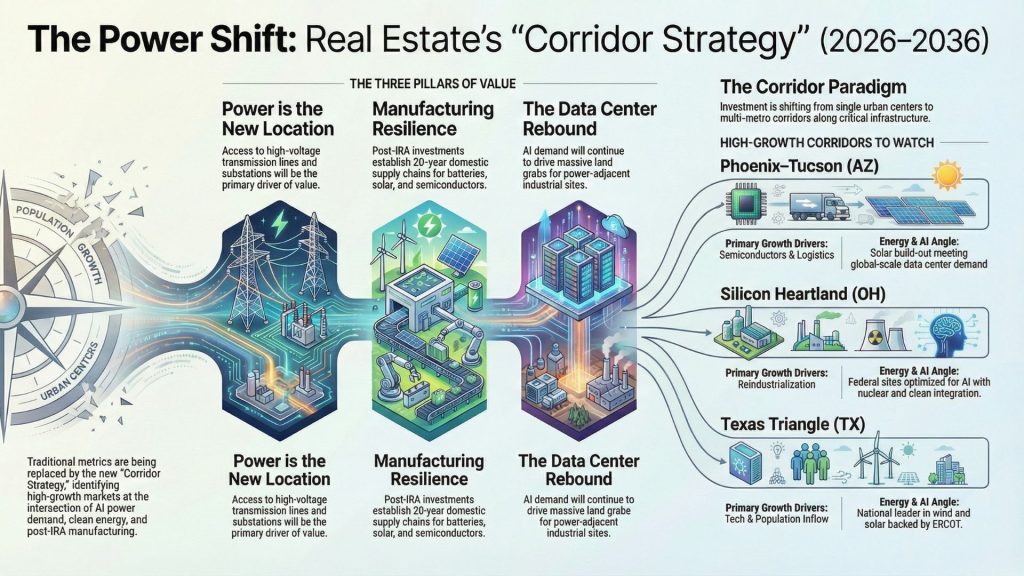

The United States is undergoing a profound structural restructuring driven by the collision of Artificial Intelligence (AI) and the accelerating energy transition. For the 2026–2036 period, location is secondary to power availability. ELIM’s investment strategy focuses on the intersection of three fundamental drivers: concentrated AI power demand, localized clean-energy generation, and post-IRA (Inflation Reduction Act) manufacturing pipelines.

The Long-Term Horizon (2036): From Data Centers to Energy Hubs

While a 3-year outlook highlights immediate bottlenecks, a 10-year strategic view reveals that these technological and policy shifts are establishing new, durable industrial corridors.

1. Power as the Primary Valuation Metric

By 2036, “speed to power” will be the defining metric for industrial and data center asset valuation. Corridors with existing high-voltage transmission lines, available substation capacity, and political willingness to fast-track energy infrastructure will command significant premiums.

2. The Reshoring Institutionalization

Post-IRA investments are not merely transitory construction projects; they represent the establishment of 20-year domestic supply chains for semiconductors, batteries, and solar components. This ensures long-term demand for industrial space and associated workforce housing in non-traditional nodes.

3. AI Energy Paradox: Scarcity vs. Growth

Efficiency gains in AI hardware are likely to be outpaced by demand growth. Therefore, the demand for power-adjacent, exurban industrial land for hyperscale data centers will continue to escalate past 2030, transforming these sites into critical, long-term national infrastructure.

Strategic Corridors (2026–2036)

Investment opportunities are shifting from single urban centers to multi-metro corridors. Data centers and clean-energy generation require vast footprints, dictating development at the urban fringe or along critical transmission arteries.

Phoenix–Tucson (AZ) serves as a primary example, where semiconductor manufacturing, massive population growth, and logistics collide with top-tier solar build-outs and immense data-center demand.

Meanwhile, the Silicon Heartland (Ohio and the Midwest) is experiencing a renaissance based on reindustrialization and the repurposing of federal sites for AI-optimized centers with integrated clean power.

In the Southeast, the EV/Battery Belt (GA, SC, NC, TN, KY) is consolidating domestic supply chains, while the Texas Triangle continues to leverage deregulated power (ERCOT), vast land, and a national lead in wind and solar to support massive data-center hubs.

Finally, Legacy Tech Hubs (Northern Virginia, Bay Area) are shifting from pure growth plays to scarcity-value bets, where power shortages in saturated markets drive value in surrounding secondary and exurban nodes.